Key Takeaways

- Flexible pay options empower employees and support retention, appealing to modern talent priorities.

- AI-driven automation enhances accuracy and reduces administrative overhead, boosting productivity.

- Keeping up-to-date with regulations is vital for compliance and risk mitigation, especially as laws shift across regions.

- Diversity in payroll systems allows organizations to better support remote and gig workers without sacrificing efficiency.

- Pay transparency encourages trust among staff and helps attract high-quality talent, reinforcing organizational reputation.

- Tech innovation future-proofs payroll processes, paving the way for adaptable, scalable business growth.

Introduction

As work environments continuously evolve, payroll systems must too. With the rise of remote teams, gig workers, and hybrid schedules, companies are encountering new and complex payroll challenges that require innovative solutions. These changes have revolutionized the way people approach work, as employees now expect more adaptability from employers, not just in workplace flexibility but also in how and when they are paid. Tackling these complexities calls for forward-thinking strategies that balance fairness, compliance, and adaptability. Employers who fail to adapt risk falling behind in the competitive race for talent and could expose themselves to regulatory and financial risks. For an in-depth look at navigating special pay scenarios, visit https://www.adp.com/resources/articles-and-insights/articles/n/navigating-3-special-pay-situations.aspx, which offers actionable insights to address diverse workforce needs.

Introducing a robust mix of flexible pay structures, harnessing new technologies like artificial intelligence, and committing to ongoing regulatory alignment can help organizations meet evolving employee expectations while maintaining their competitive edge. By doing so, businesses not only boost employee satisfaction and morale but also streamline their internal payroll processes and reduce potential compliance risks. These improvements ultimately allow companies to focus more on strategic growth and less on administrative headaches and unexpected payroll issues.

Embracing Flexible Pay Options

Employees are increasingly seeking financial flexibility from their employers as a key component of overall job satisfaction. By introducing programs like on-demand pay—which allows workers timely access to earned wages—companies can significantly ease employees’ financial anxieties and directly improve retention rates. According to industry research, 84% of workers stated that on-demand pay helped them pay most bills on time, while more than half would be less likely to seek employment elsewhere if this option were available. In a world where financial instability is a top concern for many, providing more immediate access to earned income can be a powerful motivator that differentiates forward-thinking employers from the rest. Flexible pay structures not only empower staff but also strengthen the employer brand, making businesses stand out in a competitive talent market where employee experience is often the decisive factor. Flexible systems streamline payroll for employers, too, reducing the administrative work associated with traditional payroll cycles and enabling more adaptive resource management.

Leveraging AI and Automation in Payroll

Automated payroll solutions powered by artificial intelligence are ushering in a new era of payroll administration. AI eliminates repetitive manual data entry, accurately verifies complex timesheets, and ensures that correct payment rules are automatically applied—even when dealing with multi-jurisdictional teams and unconventional schedules. These systems continue to learn and become more accurate over time, detecting anomalies and reducing the chance of human error that could lead to costly lawsuits or hefty fines. With 92% of organizations aiming to adopt AI-first payroll models by 2025, AI-powered automation is shifting from a competitive advantage to an essential business requirement. Not only does this technology help avoid costly errors, but it also frees up HR professionals and payroll administrators to focus on value-added tasks like strategic planning, workforce analysis, and employee engagement initiatives. AI-driven platforms can also easily scale as companies grow or change, allowing businesses to confidently expand into new jurisdictions without overhauling core administrative solutions.

Ensuring Compliance with Evolving Regulations

Payroll regulations are in constant flux, with new overtime laws, minimum wage requirements, and reporting standards changing frequently across cities, states, and countries. For example, the Department of Labor’s 2024 Overtime Rule—which proposed significant changes to salary exemption thresholds—was vacated by a federal court later that year, illustrating how quickly the compliance landscape can shift. Events like these remind employers of the urgent need to stay continuously updated to avoid costly penalties, litigation, or payroll disruptions. Auditing internal payroll processes regularly and leveraging compliance-focused HR platforms helps businesses stay ahead of the curve and quickly adapt to legal developments, even when guidelines change with little warning. Investment in ongoing compliance training for payroll professionals is critical, as it reduces exposure to regulatory risks and gives employers peace of mind that their processes can withstand scrutiny.

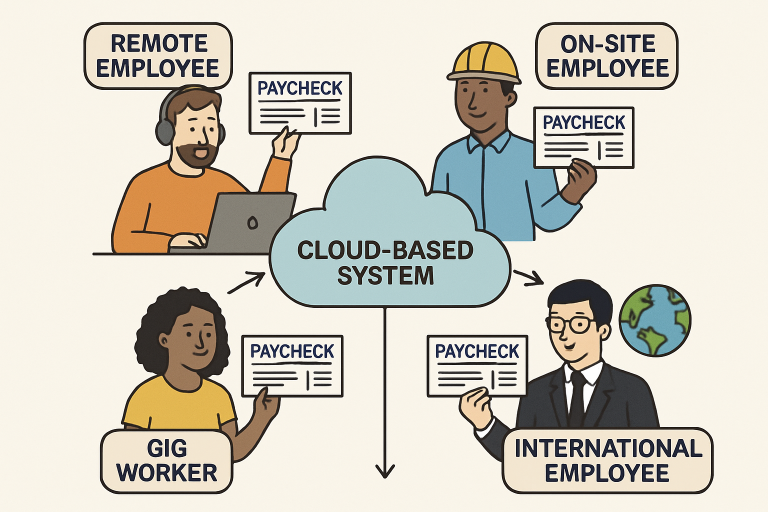

Managing Payroll for a Diverse Workforce

The traditional nine-to-five office model no longer reigns supreme. Today’s workforce increasingly consists of part-time employees, freelancers, project-based workers, remote team members, and even international contractors. Each category of worker may have distinct pay agreements, work hour expectations, and benefit eligibility criteria. Modern payroll systems must support this diversity with robust features that ensure compliance with different tax, labor, and reporting requirements based on worker type and location. Implementing technology-driven, flexible payroll solutions allows organizations to manage varying schedules and contractual relationships while simplifying compliance across state and country boundaries. Cloud-based payroll systems can consolidate all categories of workers within a single platform, providing visibility and control regardless of worker location. Ultimately, this approach fosters a more equitable and attractive workplace, strengthens employee satisfaction, and promotes retention in today’s fast-moving employment landscape.

Implementing Pay Transparency

Workers increasingly expect openness about pay practices, and the movement towards pay transparency is gaining momentum. Pay transparency—sharing compensation structures, job grades, salary bands, and pay ranges—fosters a culture of trust, inclusion, and equity. Surveys show that 75% of employers believe pay transparency helps them attract better candidates, as job-seekers increasingly prioritize open communication and fairness in compensation practices. Transparent payroll practices help dispel common misunderstandings and misinformation about wage fairness, which can be a potent source of division or disengagement among staff. By prioritizing pay transparency, organizations demonstrate a commitment to equitable treatment, reduce the risk of bias or unintentional pay gaps, and foster a more positive work environment where employees feel respected and valued.

Adapting to Technological Innovations

Organizations can further future-proof their payroll operations by embracing innovation. Cloud-based platforms now deliver secure, scalable, real-time payroll management solutions that can be accessed from anywhere, supporting remote and mobile teams efficiently. Blockchain technology is also beginning to introduce new standards of transparency, traceability, and data integrity in payroll processes, enabling real-time audits and reducing opportunities for fraud or manipulation. As digital transformation reshapes human resources, advanced analytics tools allow HR leaders to forecast payroll costs, identify pay equity gaps, and streamline payroll approvals. By integrating these emerging technologies, businesses make it easier for HR departments to reduce the risk of manual errors, achieve greater compliance, and quickly adapt to shifts in workforce demands—all of which support consistent, long-term business growth.

Conclusion

Adapting payroll practices to today’s diverse work scenarios requires a strategic blend of flexibility, transparency, and proactive measures toward compliance and technological innovation. By embracing versatile pay options, leveraging the power of AI and automation, and remaining vigilant about legal and regulatory changes, organizations can build payroll systems that provide both fairness and resilience. Such forward-thinking practices position companies to attract and retain top talent, minimize risk, and maintain their edge in a rapidly evolving business landscape focused on efficiency and employee well-being.